Clean Energy Incentives & Rebates Canada (Updated 2024)

Published by Rylan Urban on Jan 18, 2019. Last updated by Chloe McElhone on June 26, 2023.

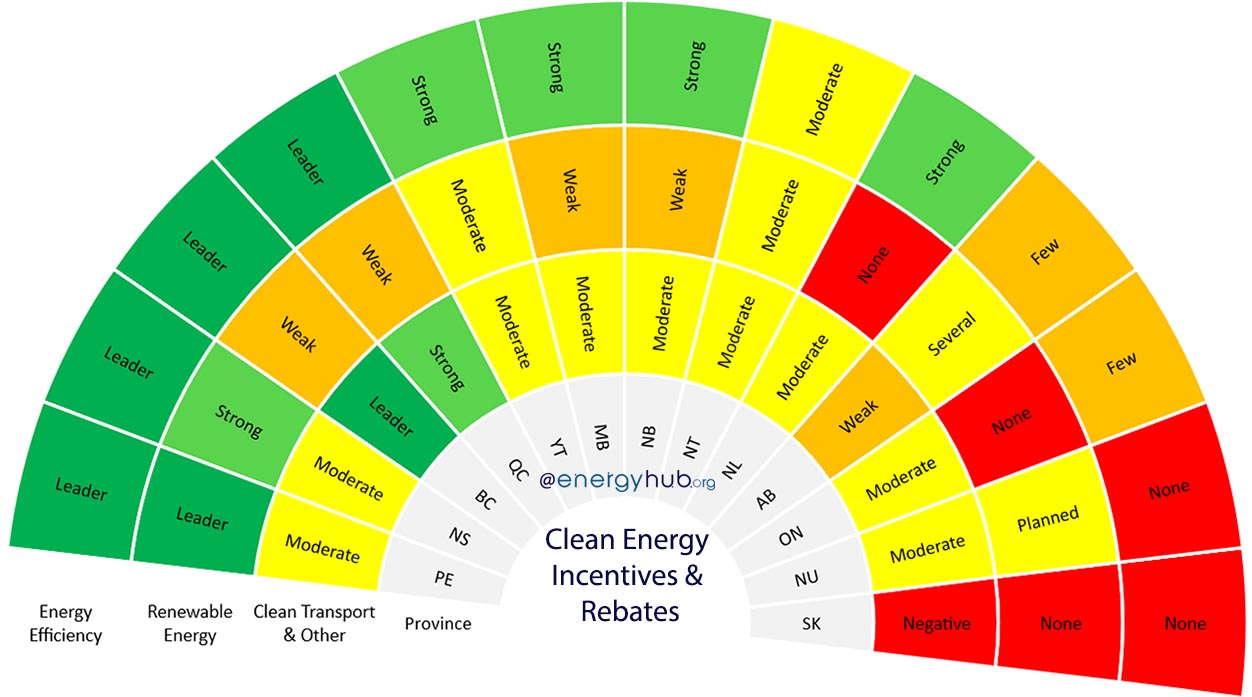

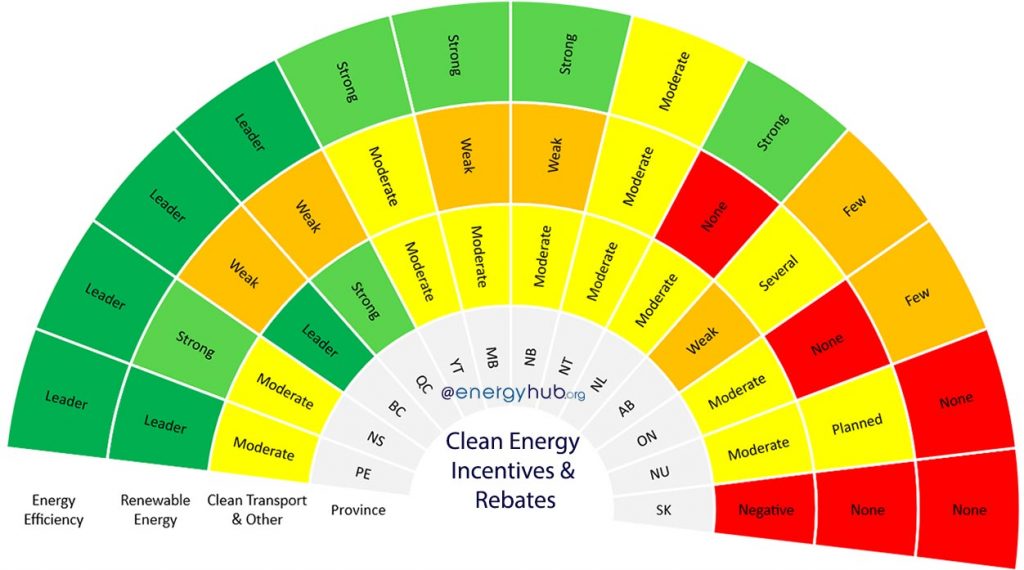

There are at least 80 clean energy incentive programs currently available across Canada. Between them, they offer hundreds of individual energy efficiency, renewable energy, clean transportation, and low-income incentives and rebates.

Clean energy incentive programs on this page are sorted by the province that they are offered in. Start your energy incentive search by clicking on your jurisdiction below:

Canada-Wide Programs

The federal government does not usually administer energy incentives. Instead, it provides provinces and territories funding to administer their own through the Low Carbon Economy Fund.

- Zero-Emission Vehicle Incentive – One notable exception is ZEV incentive offered through transport Canada. This is a $5,000 rebate that is applied automatically at the point of sale when you purchase a zero-emission vehicle.

- Canada Greener Homes Grant – Canadian homeowners may be eligible for grants up to $5,000 for the purchase and installation of energy efficiency home upgrades. You must be eligible for an EnerGuide home evaluation to access rebates on solar PV, insulation, window and door replacements, and more.

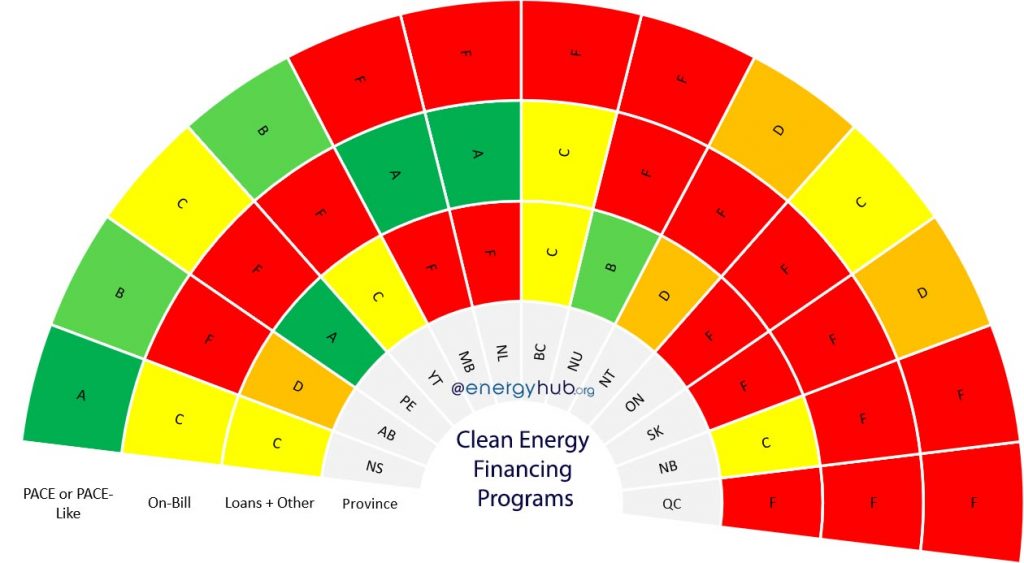

Note: Canada also offers a 10-year, interest free Greener Home Loan! See the Clean Energy Financing Page for more.

- Federal GST/HST New Housing Rebate – Homeowners may be eligible to recover a portion of the GST or HST that they paid for newly constructing or substantial renovated homes. This rebate may be useful if you’re making a large investment in energy efficiency upgrades.

- Federal Tax Incentive for Clean Energy Equipment – Businesses can also use a federal tax incentive to fully expense clean energy generation and energy efficiency equipment. This means a CCA rate of 100% and the abolishment of the first year rule as of the beginning of 2023.

- Oil to Heat Pump Affordability Program – Within the Federal Green Homes Program, there is an additional program that offers up to $10,000 for homeowners at or below the median household after-tax income to switch from oil to heat pumps in their homes.

Alberta

There are currently 7 clean energy incentive programs available in Alberta which offer dozens of individual energy efficiency, renewable energy, and clean transportation incentives and rebates.

All current programs in the province are offered by municipalities and/or utilities – no provincial programs currently exist.

Energy Efficiency Incentive Programs

- Medicine Hat HAT Smart Program – The City of Medicine Hat offers offered rebates for new energy efficiency homes, ENERGY STAR appliances, and home retrofits. As of March 30th, 2023, the Existing Homes incentive is fully subscribed; applications are still being accepted in case of additional funds.

- Banff Residential Environmental Rebate Program– The Town of Banff currently offers rebates for energy-efficient and renewable energy systems. Eligible projects include ENERGY STAR clothes washers, ENERGY STAR dishwashers, doors, ENERGY STAR furnaces, and more.

Renewable Energy Incentive Programs

- Banff Solar Production Incentive – The Town of Banff currently offers a $0.75 per watt rebate on solar energy systems, up to a maximum of 20kW. However, applications are limited each year.

- Canmore Solar Incentive Program – The Town of Canmore currently offers rebates for residential and commercial solar energy systems. However, the 2023 application window is now closed.

- Edmonton Change Homes For Climate Solar Program – The City of Edmonton currently offers a $0.40 per watt rebate for solar energy systems.

- Medicine Hat HAT Smart Program – The City of Medicine Hat is currently offering $0.2 per watt rebate for solar energy systems up to a maximum of $1,000.

- EQUS Solar Incentive – EQUS has partnered with ReWatt Power to offer its customers a $0.10 per watt rebate for solar energy systems to a maximum of $500.

British Columbia

There are at least 17 clean energy incentive programs available in British Columbia which offer well over 100 individual energy efficiency, renewable energy, clean transportation, and low-income incentives and rebates.

When looking for energy efficiency or renewable energy rebates in British Columbia, we highly recommend using the Clean BC Rebate Search Tool.

Energy Efficiency Incentive Programs

- Better Homes and Home Renovation Rebate Program – Clean BC, BC Hydro, and FortisBC are currently offering about two dozen energy efficiency rebates of up to $6,000 on a wide range of products and services including insulation, heating & water equipment, appliances, heat pumps, and much more.

- Municipalities Rebate Top-Up Program – 23 municipalities offer rebate top-ups that can combined with the Better Homes and Home Renovation Rebate Program.

- Kamloops See The Heat Program – The City of Kamloops is currently allowing residents to loan a thermal imaging camera free of charge, along with free draft proofing kit for windows, doors, and electrical switches.

- BC Energy Step Code Program – There are several municipalities that are offering incentives for new energy efficiency homes built to beat the BC Building Code. The best way to see if incentives exist in your municipality is to search for it on the Implementation Updates page of the Energy Step Code website.

- RDN Graded Site-Cut Timber Program – The districts of Nanaimo and Lantzville are currently offering an incentive for home construction or renovation projects that use graded timber located on-site for structural use.

- Vancouver Heritage Energy Retrofit Grant – The Vancouver Heritage Foundation is currently offering rebates up to $14,000 for energy efficiency upgrades on homes that were built before 1940 and or are on the Vancouver Heritage Register.

Renewable Energy Incentive Program

- PST Tax Exemption – There is currently a 7% PST exemption for alternative energy generation and energy conservation equipment in BC. This includes insulation, weather stripping, solar PV, micro-hydro, and more.

- RDN Renewable Energy System Program – The districts of Nanaimo and Lantzville are currently offering incentives up to $250 for solar PV, solar thermal, wind, and geothermal energy systems.

Clean Transportation Incentive Programs

There are currently 3 zero-emission vehicle (ZEV) incentives in British Columbia. All of these incentives, except for the Specialty use Vehicle Incentive Program, can be combined:

- Provincial Clean Energy Vehicle Program – A rebate up to $3,000, in addition to the $5,000 federal rebate. Use the search function on Go Electric BC to see which vehicle models are eligible and the rebates that apply for each.

- BC SCRAP-IT Program – A rebate up to $300 when you trade in a gas-powered vehicle, which can be combined with other rebates for up to $5,000 when purchasing an electric vehicle.

- Specialty Use Vehicle Incentive Program – Various incentives available for special and low-speed equipment such as motorcycles, forklifts, and shuttle buses.

There is currently 1 electric vehicle charging station incentive in BC.

Low Income & Indigenous Incentive Programs

- Free Energy Savings Kit Program – FortisBC, BC Hydro, and municipal utilities are offering free energy savings kits to income-qualified BC residents. Kits include facet aerators, LED lights, weather stripping, window film, and more.

- Energy Conservation Assistance Program – Similar to the free energy savings kit program, FortisBC, BC Hydro, and municipal utilities also offer free installation of these products to income-qualified BC residents, along with a free coaching on how you can save energy at home.

- FortisBC Income Qualified Program – FortisBC offers rebates on natural gas furnaces & boilers, heat pumps, and water heaters to customers whose annual household income is below a certain threshold.

- Indigenous Community Heat Pump Incentive Program – Clean BC is currently offering an 80% rebate up to $12,000 for fuel-switching heat pumps in indigenous communities.

- Indigenous Communities Conservation Program – BC Hydro is currently offering free energy efficiency products as well as special rebates for indigenous communities.

Manitoba

There are currently 6 clean energy incentive programs available in Manitoba which offer dozens of individual energy efficiency incentives and rebates.

All of these programs, except for the Green Energy Equipment Tax Credit, are offered by Efficiency Manitoba.

Energy Efficiency

- Efficiency Manitoba Energy Efficiency Program – Efficiency Manitoba currently offers several home energy rebates for smart thermostats, insulation, appliances, pool pumps, and more. There is also a separate program for advanced HRV controls.

- New Homes Program – Efficiency Manitoba currently offers rebates up to $12,000 to help build certified energy efficient new homes.

Renewable Energy Incentives

- Green Energy Equipment Tax Credit – The Government of Manitoba currently offers a tax credit for geothermal heat pump systems (7.5% – 15%) and solar thermal energy systems (10%).

- Solar Rebate Program – Efficiency Manitoba offers a rebate of up to $0.50 per watt up to 10 kilowatts and $5,000 per home for residential solar panels.

Low Income and Indigenous Incentive Programs

- Income Qualified Program – Efficiency Manitoba offers free home efficiency upgrades including insulation, gas furnaces, gas boilers, and more for residents whose household income falls below the specified limits.

- First Nations Insulation Program – Efficiency Manitoba offers free insulation, LED lighting, low-flow showerheads, faucet aerators, pipe wrap, and draft proofing for First Nations Communities.

New Brunswick

There are currently 4 clean energy incentive programs available in New Brunswick which offer dozens of individual energy efficiency, renewable energy, and low-income incentives and rebates.

All of these programs are administered by NB Power.

Energy Efficiency Incentive Programs

- Total Home Energy Savings Program – NB Power offers a comprehensive home energy efficiency program that gives homeowners access to free products such as low-flow shower heads, face aerators, and LED lights, along with over a dozen rebates on things such as insulation, heat recovery systems, air sealing, pool pumps, and more.

- New Home Energy Savings Program – NB Power offers cash incentives of up to $10,000 for new homes that exceed the National Building Code.

Renewable Energy Incentives

- Total Home Energy Savings Program – NB Power currently offers a $0.20 per watt rebate on solar photovoltaic systems (only available through the Total Home Energy Savings Program).

Low Income Incentive Programs

- Enhanced Energy Savings Program – NB Power currently offers a variety of free energy efficiency upgrades including faucet aerators, insulation, LED lighting, air sealing, and more to residents who qualify below the established household income limits.

- Community Outreach Program – NB Power gives kits including LED light bulbs, low-flow shower heads, faucet aerators, and more to non-profit organizations that work with underserved populations.

Newfoundland and Labrador

There are currently 2 clean energy incentive programs available in Newfoundland and Labrador which offer a total of about a dozen individual energy efficiency and low-income incentives and rebates.

Energy Efficiency Incentive Programs

- TakeCHARGE Residential Rebate Program – NL Hydro and NL Power currently offers about a dozen rebates on thermostats, insulation, HRVs, heating equipment, low-flow shower heads, and more.

Low Income Incentive Programs

- Home Energy Savings Program (HESP) – The Newfoundland and Labrador Housing Corporation currently offers a grant of up to $5,000 for energy efficiency upgrades to residents whose annual household income equals $32,500 or less. Homeowners must currently have diesel-generated electricity or use 1,000+ litres of oil annually.

Northwest Territories

There are currently 4 clean energy incentive programs available in the Northwest Territories which offer dozens of energy efficiency, renewable energy, and clean transportation incentives and rebates.

All of these programs are offered by the Arctic Energy Alliance.

Energy Efficiency Incentive Programs

- Energy Efficiency Incentive Program – The Arctic Energy Alliance currently offers rebates on LED lighting, home appliances, heating and heat recovery equipment, insulation, and more.

- Home Improvements Incentive Program – The Arctic Energy Alliance offers rebates on home improvement projects that reduce GHG emissions from heating homes, including insulation, windows, and more.

Renewable Energy Incentive Programs

- Renewable Energy Program – The Arctic Energy Alliance also offers a 50% rebate on the total cost of renewable generation projects (solar, wind, wood pellet heating, etc) for property owners in non-hydro communities.

To learn more about solar in the Northwest Territories, check out our Complete Guide for Solar Power in Northwest Territories.

Clean Transportation Incentive Programs

- Electric Vehicle Incentive Program – The Arctic Energy Alliance also offers a $7,500 rebate for new electric vehicles and $500 for level 2 EV charging equipment.

Nova Scotia

There are currently 8 clean energy incentive programs available in Nova Scotia which offer dozens of individual energy efficiency, renewable energy, clean transportation, and low-income incentives and rebates.

All of these programs are administered by Efficiency Nova Scotia, with the exception of the Electrify EV Rebate Program.

Energy Efficiency Incentive Programs

- Home Energy Assessment Program – Efficiency Nova Scotia offers about a dozen rebates on home energy efficiency upgrades including insulation, heat pumps, solar thermal systems, windows, doors, and more.

- Instant In Store Rebate Program – Efficiency Nova Scotia partners with retailers to offer instant rebates up to $400 on smart thermostats, appliances, and other energy efficiency produces and devices.

- Free Energy Efficient Products Program – Efficiency Nova Scotia currently offers free energy efficient products and installation including LED lighting, faucet aerators, low flow shower heads, smart thermostats, pipe wrap, and more.

- Fridge and Freezer Recycling Program – Efficiency Nova Scotia currently offers a free pick up and $50 for your old fridge or freezer, plus $10 for mini fridges and air conditioning units.

- Heating System Rebate Program – Efficiency Nova Scotia currently offers rebates up to $3,000 on various home air and water heaters including heat pumps and wood/pellet stoves.

Renewable Energy Incentive Programs

- SolarHomes Program – Efficiency Nova Scotia is currently offering a $0.30 per watt rebate on the purchase of solar photovoltaic systems.

To learn more about solar in Nova Scotia, check out our Complete Guide for Solar Power in Nova Scotia.

There are also rebates for solar thermal systems through the Heating System Rebates Program and the Home Energy Assessment Program.

Clean Transportation Incentive Programs

- Electrify EV Rebate Program – The government of Nova Scotia offers rebates of up to $3,000 for the purchase of new or used electric vehicles or $500 for e-bikes.

Low Income Incentive Programs

- HomeWarming Program – Efficiency Nova Scotia is currently offering free home energy efficiency upgrades such as insulation and air sealing to residents whose household income falls below a specified threshold.

- Affordable Multifamility Housing Program – Efficiency Nova Scotia also offers energy efficiency rebates for low-income properties including insulation, space and water heating, and more. Eligible multi-unit residential units and cooperatives can receive up to 80% in rebates and non-for-profit properties, such as shelters and transition houses, can receive upt to 100% in rebates.

Nunavut

There are currently 3 clean energy incentive programs available in Nunavut.

Renewable Energy Incentive Programs

- Renewable Energy Home Improvements Program – The Nunavut Housing Corporation provides a program offering 50% rebates up to a maximum of $30,000 to homeowners installing renewable energy home improvements.

- Renewable Energy Cabin Improvements Program – The Nunavut Climate Change Secretariat offers rebates up to $5,000 for renewable energy improvements on cabins specifically, including PV systems and wind systems.

Low Income Incentive Programs

- Home Renovation Program (HRP) – The Nunavut Housing Corporation offers additional $15,000 in energy efficiency improvements for those under the HPIE income eligibility limits.

Ontario

There are currently 4 clean energy incentive programs available in Ontario which offer about a dozen individual energy efficiency and low-income incentives and rebates.

Programs in the province are offered by the Ontario Government and Enbridge gas.

Energy Efficiency

Save ON Energy– Unfortunately, most provincial energy efficiency programs in Ontario have been cancelled. When programs are available, you can view them on the Save ON Energy website.

- Peak Perks Program (coming soon) – Save ON Energy will be offering a program for Ontario residents to reduce their energy consumption in residential thermostats during peak energy consumption times throughout the summer.

- Enbridge Home Efficiency Rebate – Enbridge Gas currently offers rebates up to $10,000 available for air sealing, high-efficiency furnaces, windows, doors, water heaters, and more.

- Enbridge Smart Thermostat Rebate – Enbridge Gas also offers a $75 rebate for smart thermostats.

Low Income Incentive Programs

- Enbridge Home Winterproofing Program – Enbridge Gas offers several free efficiency upgrades including insulation, air sealing, and smart thermostats to customers whose total annual household income is under a certain threshold.

- Energy Affordability Program – The Independent Electricity System Operator currently offers a wide-range of energy efficiency incentives to residents whose household income falls below a specified threshold. Incentives include free assessments, LED lighting, faucet aerators, and more.

Prince Edward Island

There are currently 8 clean energy incentive programs available in Prince Edward Island which offer dozens of individual energy efficiency, renewable energy, clean transportation, and low-income incentives and rebates.

These incentive programs are primarily offered by EfficiencyPEI, while a single low-income program is also co-offered by the City of Charlottetown.

Energy Efficiency Incentive Programs

- Energy Efficient Equipment Rebates – EfficiencyPEI currently offers rebates on various home air and water heating equipment including heat pumps, biomass heating systems, and more.

- Home Insulation Rebates – EfficiencyPEI currently offers rebates for insulation, air sealing, windows, doors, and skylights.

Both of these above programs (along with the Winter Warming Program, listed below) are also available to duplexes, townhouses, and apartment buildings through the Multi-Unit Residential Building Efficiency Program.

- New Home Construction Incentives – EfficiencyPEI offers an 80% rebate on building plan energy evaluations and a subsequent evaluation of the built home that can offer up to $5,000 in rebates depending on the efficiency of the new home.

- Home Energy Assessments Program – EfficiencyPEI offers home energy audits at the subsidized cost of $99.

Renewable Energy Incentive Programs

- Solar Electric Rebate Program – EfficiencyPEI also offers a $1.00 per watt incentive on solar photovoltaic systems up to 40% of installed costs up to $10,000.

To learn more about solar in Prince Edward Island, check out our Complete Guide for Solar Power in Prince Edward Island.

Clean Transportation Incentive Programs

- Electric Vehicle Incentive – The Government of PEI offers a rebate of $5,750 for the purchase of electric vehicles and $3,250 for plug-in hybrid vehicles.

Low Income Incentive Programs

- Winter Warming Program – EfficiencyPEI is offering free home air sealing, installation of a programmable thermostat, a low-flow shower head, LED light bulbs and more to PEI residents whose total annual household income equals $50,000 or less.

- Charlottetown Low-Income Financial and Technical (LIFT) Assistance Program – EfficiencyPEI and the City of Charlottetown are offering free low-flow shower heads, bathroom aerators, and toilets to Charlottetown residents whose total annual household income equals $50,000 or less.

Québec

There are currently 11 clean energy incentive programs in Québec which offer dozens of energy efficiency, renewable energy, clean transportation, and low-income incentives and rebates.

Most of these programs are offered through Transition énergétique Québec and energy distribution companies such as Hydro Québec, Gazifére, and Énergir.

Energy Efficiency Incentive Programs

- Rénoclimat Program – Transition énergétique Québec currently offers rebates for insulation, air sealing, windows, doors, water heating systems, and more.

- Chauffez vert Program – Transition énergétique Québec currently offers rebates for heat pumps and water heaters.

- Novoclimat Program – Transition énergétique Québec also offers rebate for newly built energy efficient homes.

- Gazifére Green – Gazifére is currently offering cash incentives on smart thermostats, air exchangers, and water heaters.

- Énergir Grants – Énergir is currently offering grants for replacing natural gas boilers with heat pumps (up to $5,800 in grants) and adding heat pumps to natural gas systems (up to $5,500 in grants).

Renewable Energy Incentive Programs

- Rénoclimat Program – Transition énergétique Québec currently offers rebates for geothermal heating systems.

Clean Transportation Incentive Programs

- New Vehicle Rebate – Transition énergétique Québec is currently offering a rebate of up to $7,000 for zero-emission vehicles. The rebate varies by make and model, so use this tool to determine the rebate amount that is eligible for each.

Low Income Incentive Programs

- Éconologis Program – Transition énergétique Québec currently offers rebates for low-income households, which may come with a free electronic thermostat between October and March.

- Community Housing Energy Renovation Program – Hydro Québec currently offers rebates to community housing and non-profit organizations.

- Énergir Supplement Low-Income Program – Énergir offers additional grants for homeowners participating in one of their energy efficiency programs and fall below their income threshold.

Saskatchewan

There are currently 2 clean energy incentive programs available in Saskatchewan which offer energy efficiency incentives.

Energy Efficiency Incentive Programs

- Residential Equipment Replacement Rebate – SaskEnergy offers rebates for energy efficient furnaces, boilers, and water heaters.

- New Home Environment Incentive – The City of Saskatoon offers a $500 incentive on new energy efficient homes certified through ENERGY STAR, LEED, or EnerGuide.

Clean Transportation Incentive Programs

Saskatchewan offers no incentives for clean transportation, but instead has a $150/yr tax on electric vehicles!

Yukon Territory

There is currently 4 major clean energy incentive programs in the Yukon which offer about a dozen individual energy efficiency, renewable energy, and clean transportation incentives and rebates.

The program is called the Good Energy Program and is offered by the Government of Yukon.

Energy Efficiency Incentive Programs

- Good Energy Home Energy Rebates – The Government of Yukon is currently offering rebates on heat-recovery ventilators, appliances, insulation, windows, doors, water-saving devices, and more.

- ZeroPath Rebate Program – The Government of Yukon also offers a rebate of up to $10,000 on newly constructed homes that are energy efficient and meet the program’s criteria.

Renewable Energy Incentive Programs

- Good Energy Renewable Energy Rebate – The Government of Yukon is currently offering a rebate of $0.80 per watt up to $5,000 for small-scale, renewable energy systems for households.

Clean Transportation Incentive Programs

- Transportation Rebate Program – The Government of Yukon also currently offers rebates from $3,000 to $5,000 on zero-emission vehicle, EV chargers, zero-emission snowmobiles, and electric motorcycles and bicycles.

External Resources

- Government of Canada – The federal government used to maintain a list of energy incentives for every province and territory. However, this list appears to have been last updated in June 2019.

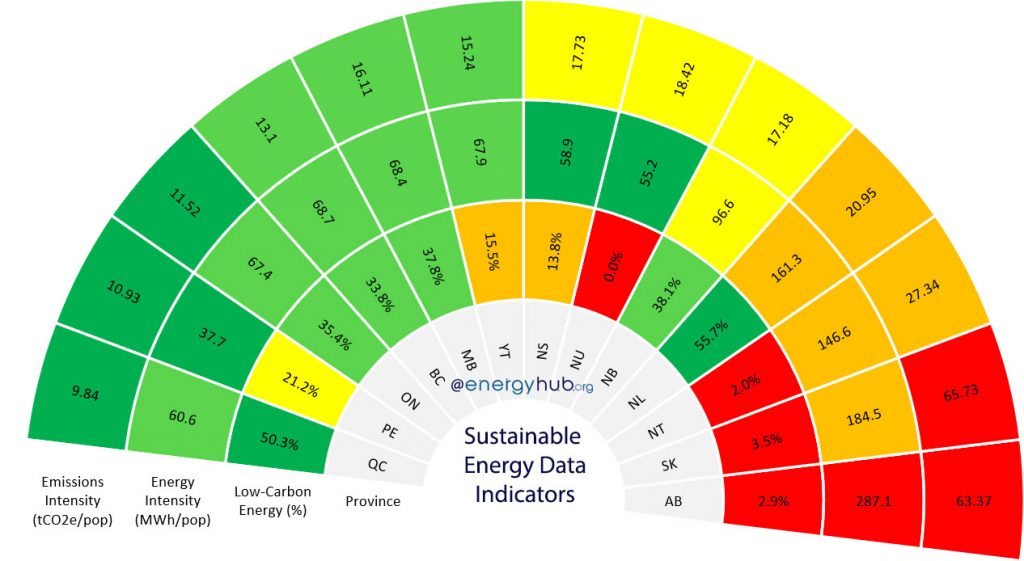

- Energy Policy Tracker – The Canada page of the Energy Policy Tracker compiles the funding provided by each province for clean energy policies. However, this dataset includes all clean energy policies beyond rebates and incentives, including financing, subsidies, and more.

More Clean Energy Reference Guides

💜 Support us by sharing this page, bookmarking it for later, or referencing us online! 💜