Carbon Tax and Rebate in Canada 2024

Published by Rylan Urban on Sep 24, 2020. Last updated on March 9, 2024

Carbon Tax in Canada

As of April 1, 2024, the Federal carbon tax in Canada is $80 per tonne of CO2e. The carbon tax will increase $15 per year until it reaches $170 per tonne in 2030.

The federal carbon tax is implemented by applying a tax on the sale of fossil fuels, based on their carbon content.

Here are the 2024 tax rates for some common fossil fuels*:

| Butane | $0.1424 per litre |

| Diesel | $0.2139 per litre |

| Gasoline | $0.1761 per litre |

| Kerosine | $0.2065 per litre |

| Natural Gas | $0.2035 per cubic metre |

| Propane | $0.1238 per litre |

*You can see the full list of fuel tax rates by clicking here.

The federal carbon tax currently applies in Alberta, Manitoba, New Brunswick, Newfoundland and Labrador, Nova Scotia, Ontario, Prince Edward Island, Saskatchewan, and partially in Nunavut and the Yukon Territory. British Columbia, Quebec and the Northwest Territories have alternative carbon pricing programs. See provincial sections below for details.

Carbon Tax Rebate

In 2024, the average qualifying individual in Canada receives a carbon tax rebate of $516.92 per year (“Canada Carbon Rebate”). The average family of 4 receives $1,219 per year.

In provinces with the full federal carbon tax (list above), the carbon tax rebate is issued via quarterly payments as indicated on the federal government schedule here.

In other provinces and territories (British Columbia, Northwest Territories, Nunavut, Quebec, and the Yukon Territory) payments are determined by the respective provincial and territorial governments.

Here is the most common tax rebate amounts currently available across Canada*:

| Carbon Rebate (Family of 4) | Carbon Rebate (Individual) | |

| Alberta | $1,800 | $900 |

| British Columbia** | $1,008 | $504 |

| Manitoba | $1,200 | $600 |

| New Brunswick | $760 | $380 |

| Newfoundland & Labrador | $1,192 | $596 |

| Nova Scotia | $824 | $412 |

| Northwest Territories*** | $1,868 | $441 |

| Nunavut | $1,232 | $308 |

| Ontario | $1,120 | $560 |

| Prince Edward Island | $880 | $440 |

| Quebec | no tax | no tax |

| Saskatchewan | $1,504 | $752 |

| Yukon Territory | $1,240 | $310 |

| Canada Average | $1,209.46 | $512.17 |

*Individuals in rural communities with the federal carbon tax receive an additional 20% top-up except in PEI where the top-up is already applied to all residents. **Rebate adjusted based on family income. See BC section for more info. ***Rebate varies by community. See NWT section for more info.

Individuals in Alberta currently receive the highest carbon tax rebate ($900/yr) and individuals in Nunavut receive the lowest carbon tax rebate ($310/mo). There is no carbon tax in Quebec.

The average person receives more money in rebates than they pay throughout the year. And the less emissions you produce (e.g., using less fuel, less natural gas, etc.) the more money you can make!

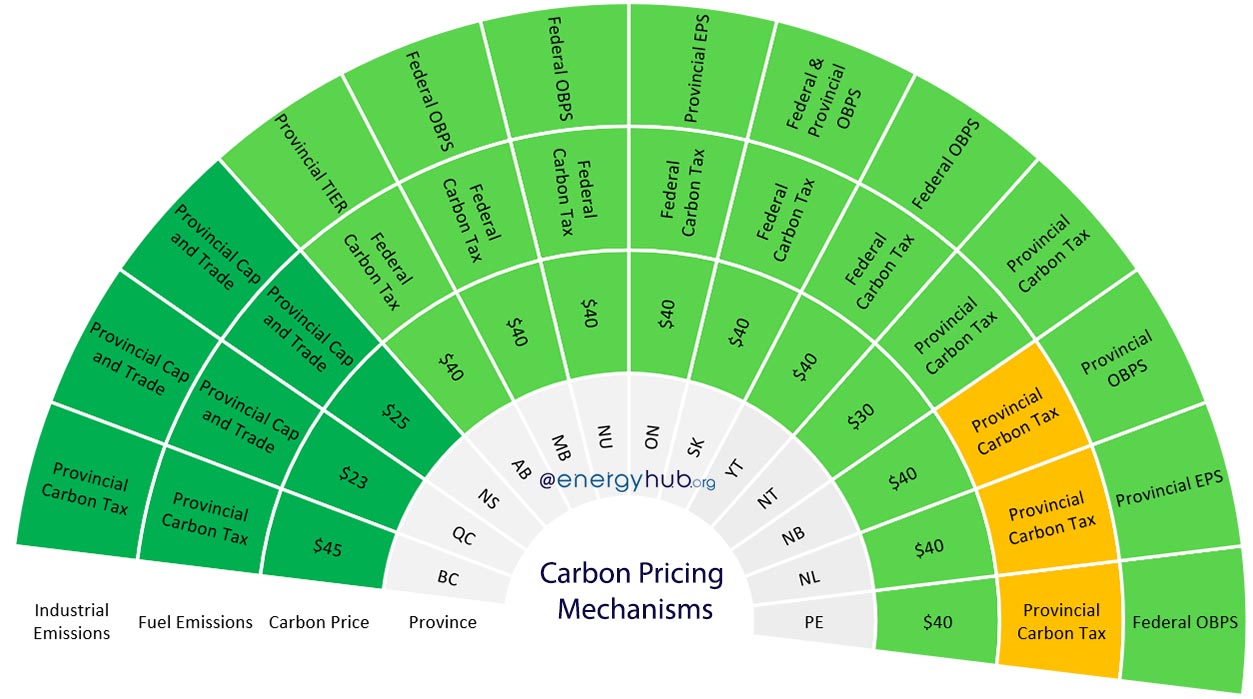

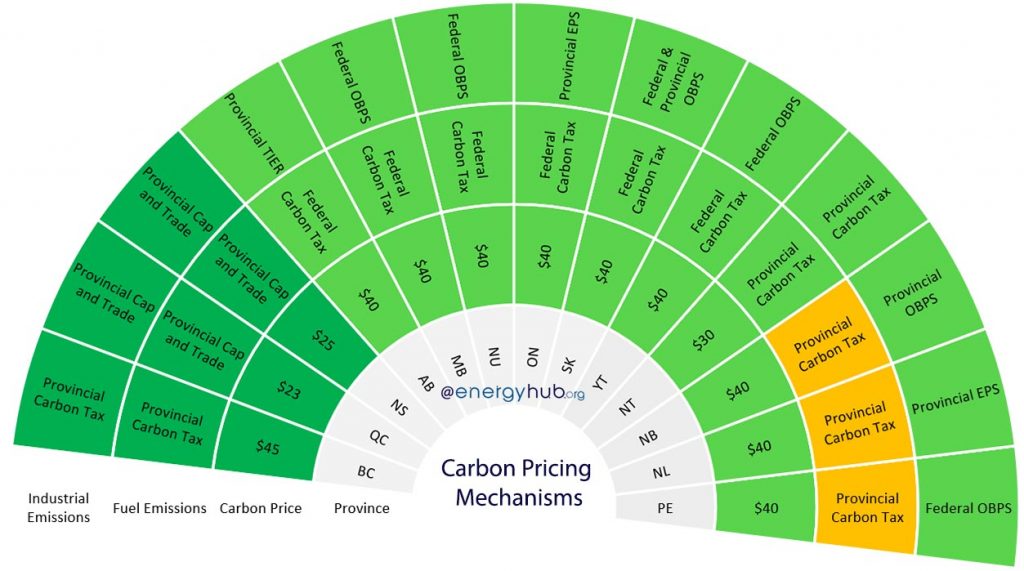

Carbon Pricing Mechanisms

Every province and territory in Canada is subject to a carbon pricing mechanism. Some jurisdictions have developed their own programs, while others use one or both of the federal programs.

In total, there are 12 different carbon pricing mechanisms in Canada. This includes 2 carbon tax programs, 9 baseline and credit systems, and 1 cap and trade systems.

This page describes the three main categories of carbon pricing mechanisms and gives a short summary of the programs that apply for each province and territory.

You can read from top to bottom, or start by clicking on your jurisdiction below:

Carbon Pricing Overview

All carbon pricing mechanisms in Canada fall into one of three main categories:

1. Carbon Tax

A carbon tax, often implemented as a ‘fuel charge’, is the most common carbon pricing mechanism in Canada. It works by applying an additional charge to the price of fossil fuels, based on the fuel’s carbon content.

For example, a lower carbon fuel (such as propane) might have a fuel charge of $0.12 per litre, while a higher carbon fuel (such as gasoline) might have a fuel charge of $0.17 per litre.

All province except Quebec currently have a carbon tax.

2. Baseline and Credit System

Baseline and credit systems, including performance standards and output-based pricing systems, are the second most common type of carbon pricing mechanism in Canada. They only apply to industrial emissions.

The specifics vary across provinces, but baseline and credit systems generally work by allocating a ‘baseline’ amount of emissions that each industrial facility is allowed to release.

If a facility emits less emissions than their baseline, they earn ‘credits’ that can used to offset emissions in future years. If a facility emits more emissions than their baseline, they must buy credits.

Alberta, Manitoba, New Brunswick, Newfoundland and Labrador, Nunavut, Ontario, PEI, Saskatchewan, and the Yukon Territory all have a baseline and credit system for industrial emissions.

3. Cap and Trade System

The least common type of carbon pricing mechanism in Canada is the cap and trade system. Similar to baseline and credit systems, cap and trade systems only applies to industrial emissions.

In general, cap and trade systems work by setting a ‘cap’ on the total amount of emissions that can be released within a given jurisdiction. Emissions within this cap are then distributed freely to industrial facilities, or sold to them in an auction.

If a facility releases less emissions than their allocated or purchased amount, they earn credits that they can ‘trade’ to other facilities. Facilities that release more emissions than their allocated or purchased amount must buy credits.

Quebec is the only Canadian jurisdictions with cap and trade systems. Ontario and Nova Scotia also formerly had cap and trade systems.

Carbon Tax Rebate Overview

Each province and territory uses carbon tax proceeds in different ways. Often times, funds are returned to individuals in the form of quarterly payments. Provinces also use the funds to reduce other forms of taxes (i.e. income tax) or fund clean energy projects (either directly, or through rebate programs).

Federal Carbon Pricing Programs

The federal government has developed two carbon pricing mechanisms – the federal fuel charge (often called the ‘pollution price’ or ‘carbon tax’) and federal baseline and credit system for industrial facilities.

These two programs are referred to as the ‘federal backstop‘, and only apply in provinces and territories that haven’t developed their own carbon pricing programs.

Federal Fuel Charge (Carbon Tax)

The federal fuel charge works by applying a tax on the sale of fossil fuels, as described at the top of this page.

The federal carbon tax currently applies in Alberta, Manitoba, Newfoundland and Labrador, New Brunswick, Nova Scotia, Ontario, Prince Edward Island, Saskatchewan, and partially in Nunavut and the Yukon Territory.

Canada Carbon Rebate

Approximately 90% of funds collected through the federal carbon tax is distributed back directly to residents in the provinces where the funds were collected.

The amount that individuals receive depends on the number of people within their household, as described at the top of this page.

You can see the full details about the federal Canada Carbon Rebate here.

Federal Baseline and Credit System

The federal baseline and credit system is called the Federal Output-Based Pricing System (OBPS). This system applies to industrial facilities that emit more than 50,000 tonnes of CO2e per year.

Under the Federal OBPS, each industrial polluter is allowed to release a baseline amount of emissions per unit of product produced, based on a national performance standard.

For example, here are the baseline emission amounts for three common products:

- 650 tonnes of CO2e per GWh of electricity produced from solid fuels

- 0.216 tonnes of CO2e per vehicle produced

- 0.0728 tonnes of CO2e per tonnes of potatoes processes for animal or human consumption

Click here to see a full list of the federal output-based standards.

If a polluter beats the standard, they earn credits that they may be able to save or sell. If they don’t beat the standard, they must buy credits to offset their excess emissions. Industrial facilities can also buy emissions offsets through the Federal Greenhouse Gas Offset System.

The federal baseline and credit system currently applies in Manitoba, Nunavut, Prince Edward Island, the Yukon Territory.

Alberta

Emissions in Alberta are covered by a combination of provincial and federal carbon pricing mechanisms.

Alberta Carbon Tax

Alberta has chosen not to implement its own carbon tax and thus the federal carbon tax applies:

As of April 1, 2024, the carbon tax in Alberta is $80 per tonne of CO2e. It will increase $15 per year until it reaches $170 per tonne in 2030.

Because the federal carbon tax applies in Alberta, Alberta residents receive Canada Carbon Rebate payments on a quarterly basis.

In 2024, the average qualifying individual in Alberta receives a carbon tax rebate of $900 per year and the average family of 4 receives $1,800 per year.

Alberta Baseline and Credit System

Alberta’s baseline and credit system is called the Alberta Technology Innovation and Emissions Reduction (TIER) Regulation. TIER applies to industrial facilities that emit more than 100,000 tonnes of CO2e per year.

Under Alberta’s TIER, each emitter is required to reduce its emissions by 10% compared to a 2013-2015 baseline. If an emitter releases more than their allocated baseline amount, they pay $30 per tonne. If they release less, then they earn credits that they can carry forward for future years.

Industrial polluters can also participate in the Alberta Emission Offset System. Starting in 2021, industrial emitters have to reduce their emissions by 1% annually.

British Columbia

All emissions in British Columbia, including industrial emissions, are covered by the province’s carbon tax.

Industrial facilities may also participate in the CleanBC Industry Fund and the CleanBC Industrial Incentive Program. Some industrial and public sector polluters can also participate in the BC’s GHG Emissions Offset Program.

British Columbia Carbon Tax

As of April 1, 2024, the carbon tax in British Columbia is $60 per tonne of CO2e.

British Columbia’s Carbon Tax works by applying an additional charge to the sale of fossil fuels, based on their carbon content.

Here are the 2023 fuel charges rates for some common fossil fuels:

- Gasoline: $0.1431 per litre

- Natural Gas: $0.1239 per cubic metre

- Diesel: $0.1685 per litre

Low-income BC resident are also eligible to receive BC Climate Action Tax Credit payments. However, unlike other provinces, the amount you receive depends on your family income.

In 2024, the average qualifying individual in British Columbia receives a carbon tax rebate of $504 per year and the average family of 4 receives $1,008 per year.

If your adjusted family net income is above a certain threshold, the climate action payments are reduced. It is also possible to not receive any payments if your personal or family income is high.

Manitoba

All emissions in Manitoba are currently taxed through federal programs.

Manitoba Carbon Tax

Manitoba has chosen not to implement its own carbon tax and thus the federal carbon tax applies:

As of April 1, 2024, the carbon tax in Manitoba is $80 per tonne of CO2e. It will increase $15 per year until it reaches $170 per tonne in 2030.

Because the federal carbon tax applies in Manitoba, Manitoba residents receive Canada Carbon Rebate payments on a quarterly basis.

In 2024, the average qualifying individual in Manitoba receives a carbon tax rebate of $600 per year and the average family of 4 receives $1,200 per year.

New Brunswick

All emissions in New Brunswick are currently taxed through a combination of federal and provincial programs.

New Brunswick Carbon Tax

New Brunswick has chosen not to implement its own carbon tax and thus the federal carbon tax applies:

As of April 1, 2024, the carbon tax in New Brunswick is $80 per tonne of CO2e. It will increase $15 per year until it reaches $170 per tonne in 2030.

Because the federal carbon tax applies in New Brunswick, New Brunswick residents receive Canada Carbon Rebate payments on a quarterly basis.

In 2024, the average qualifying individual in New Brunswick receives a carbon tax rebate of $380 per year and the average family of 4 receives $760 per year.

New Brunswick Baseline and Credit System

New Brunswick’s baseline and credit system is called the New Brunswick Output-Based Pricing System (OBPS). The OBPS applies to industrial facilities that emit more than 50,000 tonnes of CO2e per year.

Under New Brunswick’s OBPS, each emitter is required to reduce its emissions annually compared to a historical baseline. If an emitter releases more than their allocated baseline amount, they pay $30 per tonne. If they release less, they earn credits that they can carry forward for future years.

Newfoundland and Labrador

All emissions in Newfoundland and Labrador are currently taxed through a combination of federal and provincial programs.

Newfoundland and Labrador Carbon Tax

Newfoundland and Labrador has chosen not to implement its own carbon tax and thus the federal carbon tax applies:

As of April 1, 2024, the carbon tax in Newfoundland and Labrador is $80 per tonne of CO2e. It will increase $15 per year until it reaches $170 per tonne in 2030.

Because the federal carbon tax applies in Newfoundland and Labrador, Newfoundland and Labrador residents receive Canada Carbon Rebate payments on a quarterly basis.

In 2024, the average qualifying individual in Newfoundland and Labrador receives a carbon tax rebate of $596 per year and the average family of 4 receives $1,192 per year.

Newfoundland and Labrador Baseline and Credit System

Newfoundland and Labrador’s baseline and credit system is called the Newfoundland and Labrador Emissions Performance Standard System (EPS). The performance standard system applies to industrial facilities that emit more than 25,000 tonnes of CO2e per year.

Under the Newfoundland and Labrador’s EPS, each emitter is required to reduce its emissions annually, starting with a baseline amount determined by the facility’s historical emissions or by a sector benchmark.

If an emitter releases more than their allocated baseline amount, they must purchase emissions credits. If they release less, then they earn credits that they can carry forward for future years.

Northwest Territories

All emissions in the Northwest Territories, including industrial emissions, are covered by the territories’ carbon tax. Special considerations apply to Large Industrial Emitters.

Northwest Territories Carbon Tax

As of April 1, 2024, the carbon tax in the Northwest Territories is $80 per tonne of CO2e. It will increase $15 per year until it reaches $170 per tonne in 2030.

The Northwest Territories Carbon Tax works by applying an additional charge to the sale of fossil fuels, based on their carbon content.

Here are the 2024 fuel charges rates for some common fossil fuels:

- Gasoline: $0.1761 per litre

- Diesel: $0.2139 per litre

- Propane: $0.1238 per cubic metre

- Aviation fuels are exempt.

You can see the full list of NT fuel charge rates here.

All Northwest Territory residents receive Cost of Living Offset Payments to help offset personal carbon tax costs. The payment depends on the community in which you live.

In 2024, the average qualifying individual in Newfoundland and Labrador receives a carbon tax rebate of $596 per year and the average family of 4 receives $1,192 per year.

Nova Scotia

Emissions in Nova Scotia are covered by a combination of provincial and federal carbon pricing mechanisms.

Nova Scotia Carbon Tax

Nova Scotia has chosen not to implement its own carbon tax and thus the federal carbon tax applies:

As of April 1, 2024, the carbon tax in Nova Scotia is $80 per tonne of CO2e. It will increase $15 per year until it reaches $170 per tonne in 2030.

Because the federal carbon tax applies in Nova Scotia, Nova Scotia residents receive Canada Carbon Rebate payments on a quarterly basis.

In 2024, the average qualifying individual in Nova Scotia receives a carbon tax rebate of $412 per year and the average family of 4 receives $824 per year.

Nova Scotia Baseline and Credit System

Nova Scotia has recently ended the Nova Scotia Cap and Trade Program (CaT) and instead has implemented a baseline and credit system called the Output-based Pricing System.

The output-based system applies to industrial and power generation facilities that emit more than 50,000 tonnes of CO2e per year.

Under the system, each emitter is required to reduce its emissions by 1.5% annually, starting with a baseline amount determined by the facility’s historical emissions.

If an emitter releases more than their allocated baseline amount, they must purchase emissions credits. If they release less, then they earn credits that they can then sell to other emitters.

Nunavut

All emissions in Nunavut are currently taxed through federal programs.

Nunavut Carbon Tax

Nunavut has chosen not to implement its own carbon tax and thus the federal carbon tax applies*:

As of April 1, 2024, the carbon tax in Nunavut is $80 per tonne of CO2e. It will increase $15 per year until it reaches $170 per tonne in 2030.

*Nunavut has a carbon tax exception for aviation fuel.

Unlike the provinces where carbon tax proceeds are returned directly to residents through Canada Carbon Rebate payments, carbon tax proceeds in Nunavut are returned to residents through the Nunavut Carbon Credit.

In 2024, the average qualifying individual in Nunavut receives a carbon tax rebate of $308 per year and the average family of 4 receives $1,232 per year.

Ontario

All emissions in Ontario are currently taxed through a combination of provincial and federal programs.

Ontario Carbon Tax

Ontario has chosen not to implement its own carbon tax and thus the federal carbon tax applies:

As of April 1, 2024, the carbon tax in Ontario is $80 per tonne of CO2e. It will increase $15 per year until it reaches $170 per tonne in 2030.

Because the federal carbon tax applies in Ontario, Ontario residents receive Canada Carbon Rebate payments on a quarterly basis.

In 2024, the average qualifying individual in Ontario receives a carbon tax rebate of $560 per year and the average family of 4 receives $1,120 per year.

Ontario Baseline and Credit System

Ontario’s baseline and credit system is called the Ontario Emissions Performance Standard (EPS). The performance standard system applies to industrial facilities that emit more than 50,000 tonnes of CO2e per year.

Under the province’s performance standard system, each emitter is required to reduce its emissions annually, starting with a baseline amount determined by the facility’s historical emissions.

If an emitter releases more than their allocated baseline amount, they must purchase emissions credits. If they release less, then they earn credits that they can carry forward for future years.

Prince Edward Island

All emissions in Prince Edward Island are currently taxed through federal programs.

Prince Edward Island Carbon Tax

Prince Edward Island has chosen not to implement its own carbon tax and thus the federal carbon tax applies:

As of April 1, 2024, the carbon tax in Prince Edward Island is $80 per tonne of CO2e. It will increase $15 per year until it reaches $170 per tonne in 2030.

Because the federal carbon tax applies in Prince Edward Island, PEI residents receive Canada Carbon Rebate payments on a quarterly basis.

In 2024, the average qualifying individual in Prince Edward Island receives a carbon tax rebate of $440 per year and the average family of 4 receives $880 per year.

Québec

All emissions in Quebec, including industrial emissions, are covered by the province’s cap and trade program.

Cap and Trade System

As of November 15, 2023 the current carbon price for allowances sold at auction in Quebec is $53.16 per tonne of CO2e. (auction history)

The Quebec Cap and Trade Program (CaT) is linked with California’s CaT (and previously with Ontario’s CaT, before it was cancelled by the current Ontario conservative government) through the Western Climate Initiative. This means that CaT participants in Quebec and California can trade emission credits with each other.

The Quebec CaT applies to all emissions from provincial fuel distributors, and all facilities in the industrial and electricity generation sectors that emit more than 25,000 tonnes of CO2e annually. The full list of Quebec participants can be found here.

Under the CaT, the government sets a limit on the total emissions can be released annually. Emissions allowances are then sold in auction to participating facilities.

If an emitter releases more emission than they purchased credits for, they must buy more credits in the auction or from another participant. If they release less, then they earn credits that they can sell in the auction or directly to another participant.

Saskatchewan

All emissions in Saskatchewan are currently taxed through a combination of provincial and federal programs.

Saskatchewan Carbon Tax

Saskatchewan has chosen not to implement its own carbon tax and thus the federal carbon tax applies:

As of April 1, 2024, the carbon tax in Saskatchewan is $80 per tonne of CO2e. It will increase $15 per year until it reaches $170 per tonne in 2030.

Because the federal carbon tax applies in Saskatchewan, Saskatchewan residents receive Canada Carbon Rebate payments on a quarterly basis.

In 2024, the average qualifying individual in Saskatchewan receives a carbon tax rebate of $752 per year and the average family of 4 receives $1,504 per year.

Saskatchewan Baseline and Credit System

Saskatchewan’s baseline and credit system is called the Saskatchewan Output Based Performance Standards (OBPS). The OBPS applies to industrial facilities that emit more than 25,000 tonnes of CO2e per year, except in the electricity generation and natural gas transmission sectors.

Under Saskatchewan’s OBPS, each industrial polluter will be allowed to release a baseline amount of emissions per unit of product produced, based on the facilities historical emissions. The baseline will then decrease every year, by approximately 5% by 2030 for most sectors.

If an emitter releases more than their allocated baseline amount, they will need to purchase a credit or contribute to the province’s technology fund. If they release less, then they earn credits that they can carry forward for future years.

Yukon Territory

All emissions in the Yukon Territory are currently taxed federal programs.

Yukon Territory Carbon Tax

The Yukon Territory has chosen not to implement its own carbon tax and thus the federal carbon tax applies*:

As of April 1, 2024, the carbon tax in the Yukon Territory is $80 per tonne of CO2e. It will increase $15 per year until it reaches $170 per tonne in 2030.

*The Yukon Territory has a carbon tax exception for aviation fuel.

Unlike the provinces where carbon tax proceeds are returned directly to residents through Canada Carbon Rebate payments, carbon tax proceeds in the Yukon Territory are returned to residents through the Yukon’s carbon rebate.

In 2024, the average qualifying individual in the Yukon Territory receives a carbon tax rebate of $310 per year and the average family of 4 receives $1,240 per year.

More Clean Energy Reference Guides

💜 Support us by sharing this page, bookmarking it for later, or referencing us online! 💜